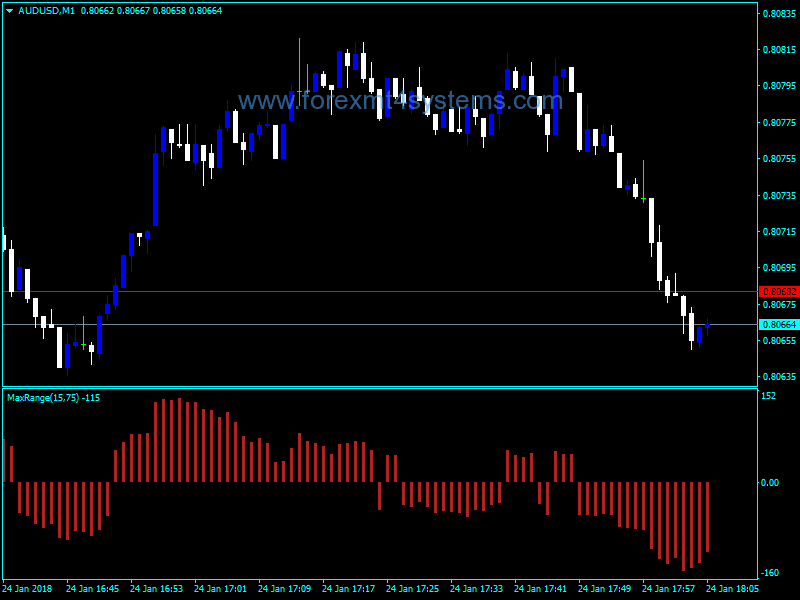

Metatrader 4 and Range Bars Chart. The funny things it also same like renko bar, it will change every indicator action. You can doing some experiment with your forex system maybe it will increase probability winning and have good performance in future but don't expect holy grail result, you won't find it. 1 7/13/ · Most of the forex majors can have a range bar value of 15 – 20 pips and higher. This allows traders to build intraday trading strategies that also take into account the spread of the instrument Estimated Reading Time: 3 mins 6/4/ · Range Bars is an indicator that can be located in the MQL5 marketplace. There may be other indicators with similar names, so to avoid any confusion we have provided a link to the correct one below. The indicator was created by Artur Zas and was first uploaded on the 22nd of August , it was last updated on the 4th of June and is currently at version

Range Bars Custom Indicator Review | Forex Academy

Now, l admit I forex range bars not trade using range bars or range charts but this topic has been something that has been at the back of my mind for some time so I decided to dig into a it a little bit more, forex range bars.

I hate consolidation and price whipsaws and spikes forex range bars are so prevalent in time based charts. It is frustrating. There is only one word that describe the two situations given above in the forex trading world and that word is volatility.

The first situation describes a low volatility situation, and the second situation is an example of a high volatility situation. The price of a currency pair with a high volatility will travel in a larger range in a given time period compared to a low volatility currency pair.

If the average daily range of GBPJPY is pips and 50 Pips for NZDUSD, which currency pair has more volatility then? Obviously, its GBPJPY. On a similar token, which currency pair will have more volatility in Asian forex trading session, USDJPY or EURUSD?

It will most like be USDJPY because during the Asian forex trading Session, USDJPY tends to be traded a lot as this is when Asia wakes up to trade. Trading when volatility is high is what traders look forward to but what happens when volatility is low when price enters longer periods of consolidation? How do you deal with that? A period of low volatility results in price consolidation. So how do you know if the consolidation has ended and you can forex range bars trading again?

The good news is this: there are few ways to deal with choppy markets and one of them is by using Range Candles or Range Bars as some call it.

Trading during a price consolidation phase is a really frustrating thing for many traders, forex range bars. Vicente Nicolellis was trading a market that was very unstable and also unpredictable and so there will be longer period of times when the market will be traveling sideways or doing what is called a consolidation phase. There was no way he could achieve some level of predictability of the market if he was going to use charts where price bars or candlesticks were created based time: for example, if you have a 1 minute chart of EURUSD, each bar or candlestick that you see there reflects the open, high, low and close prices within that 1 minute.

After that, the next 1 minute candlestick forms…and the process continues. After a careful and lengthy study, he concluded that if he eliminated time from the formation of the bars, that would tame the volatility issues he was facing. He developed a price bar that only used price. Now, you are wondering: how?

Well, this is how:. By making sure that a bar is formed only when a specified price range has been achieved. This eliminates the time factor in the formation of bars. The result of doing this is that a very long time period of price consolidation forex range bars be forex range bars into just a few bars, forex range bars, thus removing the noise in the market.

That is how Vicente Nicolellis became the creator of range bars. Range bars range candlesticks are price bars that take only forex range bars into consideration without the need for time. Yes, time will be present on the chart but it is relative. In other words, time is not relevant.

This means that a range bar chart is not linear. Let me explain what linear means here:. In a normal range bar chart or a candlestick chart, forex range bars, a candlestick forms only after a certain period of time.

On a metatrader 4 chart, forex range bars, you have 9 different timeframes from the smallest timeframe of 1 minute up to the monthly timeframe, forex range bars. Now, on a range bar chart. A range bar only forms when a specified range of price is achieved.

For example, forex range bars, if a specified range of 10 pips is desired than the next bar will form only when price makes the 10 pips range, forex range bars. So what do you think will happen if for example no 10 pips range is made during the last 5 hours?

Answer: no new range bar will be formed. So as you can see, this is a non-linear type of chart. The chart shown below is a 10 pip range chart of USDCAD.

Range bars take only price into consideration. Which means that each bar that forms represents a specified movement of price.

You maybe familiar with viewing bar charts based on time ; for instance, a minute chart where one bar shows the price activity for each minute time period.

Time-based charts, such as the minute chart in this example, forex range bars, will always print the same number of bars during each trading session, regardless of volatility, volume or any other factor. The number of range bars created during a trading session will also depend on the instrument being charted and the specified price movement of the range bar. So do range bars come in MT4 trading platform? Unfortunately no.

You see, range bars are not a default part of the mt4 trading programs so in order to trade range bars on mt4, you need to use and indicator or an expert advisors. Reading range candlestick information is no different from reading any other candlestick chart except that time is irrelevant.

The next thing to remember is that every range bar will be of the same length because the range will be constant. For example, if you specify a 10 pips range, every bar that forms will have a length of 10 pips. To really see the forex range bars between a range chart vs a normal candlestick chart, we have to compare the exact same charts of both side by side.

When you look at the two charts above, you can see there is a lot more clarity in the range bar chart than the normal candlestick chart:. Trading range charts is no different than trading normal bar charts and candlestick charts. You can pretty much use the same type of forex trading strategies that and systems that you use on a normal time based price chart.

What are the real benefits of trading with Range charts? Range charts do not use time in the formation of a range candlestick and only focus on on thing only: price action, forex range bars.

So if price does not move, the chart does not move. Range bars sound like a price action traders dream. While this may be true to an extent, range candlesticks have one main disadvantage: they are not useful for OHLC Open High Low Close analysis. Why is that? Because it i based on how the range bar or candlestick is calculated: you specify each range bar to break once it exceeds the specified range, so the bars always close at the extreme top or bottom.

Because of this artificial close, most candlestick patterns like the forex reversal candlestick patterns are ineffective on range charts, forex range bars. However, you will notice on the forex range bars bar chart above that, candlesticks like the bearish and bullish pin bars can be easily identified and traded. While range bars are not a type of technical indicator, they are a useful tool that forex traders can employ to identify trends and to interpret forex range bars. Since range bars take only price into consideration, and not time or other factors, forex range bars provide traders with a new view of price activity.

Spending time observing range bars in action is the best way to establish the most useful settings for a particular trading instrument and trading style, and to determine how to effectively apply them to a trading system. Home MT4 Indicators Forex Brokers Forex Strategies Forex range bars Patterns. What are range candlesticks or range bars or range charts? Well, thanks to this trader by the name of Vicente Nicolellis, that is now a reality.

You see, when you execute a trade, two things can happen: The price seems to go nowhere simply because there is no significant move up or down and you are stuck there watching your trade that is not going anywhere. Trading in such a situation can be extremely frustrating. This is not the kind of market that you want to be trading in. Price really moves over a large range of values either up or down and when you trade in such a situation as this, you will know relatively quickly that your trade is going to be a loser or a winner because your profit target gets hit or your stop loss gets hit fairly quickly.

This is the kind of market where forex traders prefer to trade in, forex range bars. Table Of Contents The Definition of Volatility in Forex Trading History Of Range Bars What Are Range Bars? Calculating Range Bars Range Bars On MT4 Trading Platform How To Read Range Candles Range Chart Vs Candlestick Charts Benefits Of Range Bars Disadvantages of Range Bars Summary.

3 Indicators to Improve your Trading

, time: 8:073 Forex Strategies with Range Bars That Work | Practice

Metatrader 4 and Range Bars Chart. The funny things it also same like renko bar, it will change every indicator action. You can doing some experiment with your forex system maybe it will increase probability winning and have good performance in future but don't expect holy grail result, you won't find it. 1 The range bars also allow us to identify formations and price patterns easily and to spot entries earlier – we don’t need to wait for a four hour bar to close to know that price has formed a double top or bottom or that price has retraced and is now resuming the original blogger.comted Reading Time: 4 mins Range bars were introduced in the middle of the 90s by Vicente Nicolellis, a Brazilian broker and trader who spent a decade managing a trading desk in San Paulo. Nowadays, range bars are gaining popularity among Forex traders. Range bars are a great tool to interpret and assess market volatility and make profitable entriesEstimated Reading Time: 6 mins

No comments:

Post a Comment