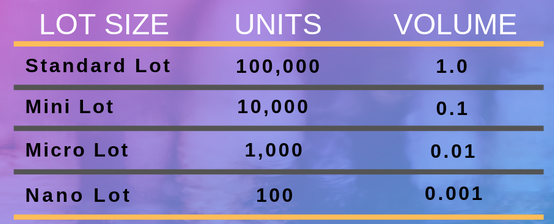

3/21/ · On the other hand, it is possible to calculate the forex position size by using the forex lot size formula. Forex Lot/ Position Size = Risk Amount/ (Stop Loss X Value Per Pip) Calculate Forex Lot Size Effectively Using Pip ValueEstimated Reading Time: 7 mins 5/22/ · Forex Trading Lot Sizes. Standard lot = , of base currency – £10 per pip Mini lot = 10, of base currency – £1 per pip Micro lot = 1, of base currency – £ per pip. This provides a foundation for the different lot sizes available to take for a Forex blogger.comted Reading Time: 2 mins 5/21/ · Lots traded = So your position size for this trade should be eight mini lots and one micro lot. With this formula in mind along with the 1% rule, you're well equipped to calculate the lot size and position on your forex blogger.comted Reading Time: 5 mins

How to Determine Position Size When Forex Trading

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. See our updated Privacy Policy here. Note: Low and High figures are for the trading day, how to compute lots in forex.

One of the important steps when day trading, is deciding how big your position should be. Position size is a function of leverage and while trading a large position may multiply a win, it can exponentially increase the value of a potential loss.

This is why traders should always consider position size in trading. To help, today we will review how to determine the correct lot size for your trading. Before you can select an appropriate lot size, you need to determine your risk in terms of percentages. The math is fairly self-explanatory, and you will find the basic equation used below. Once you have a risk percentage in mindhow to compute lots in forex, we can move to the next step in determining an appropriate position size.

As with any open position, a stop should be set to determine where a trader wishes to exit a trade in the event the market moves against them. There are virtually countless ways stops can be placed. Normally traders will use key lines of support and resistance for order placements. Traders can use price action, pivots, Fibonacci, or other methods for finding these values.

The idea is with whatever how to compute lots in forex you decide, count the number of how to compute lots in forex from your open price to your stop order.

Keep this value in mind as we move to the last step of the process. The last step in determining lot size, is to determine the pip cost for your trade. Pip cost is how much you will gain, or lose per pip. As your lot size increases, so does your pip cost. Conversely if you trade a smaller lot size, your profit or loss per pip will decrease as well. Which leaves the final question, how big should your trade size be? The total at this point is the amount per pip you should be risking.

On pairs like the EURUSDthis means trading a k lot! Most traders are right on a majority of their trades, yet their trading account is unprofitable over time. We've researched and answered this phenomenon on page 5 of our traits of a successful trader guide. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets, how to compute lots in forex.

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you how to compute lots in forex on your personal circumstances. Forex trading involves risk. Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. FX Publications Inc dba DailyFX is registered with the Commodities Futures Trading Commission as a Guaranteed Introducing Broker and how to compute lots in forex a member of the National Futures Association ID Registered Address: 32 Old Slip, Suite ; New York, NY FX Publications Inc is a subsidiary of IG US Holdings, Inc a company registered in Delaware under number Sign up now to get the information you need!

Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content.

For more info on how we might use your data, see our privacy notice and access policy and privacy website. Check your email for further instructions. Live Webinar Live Webinar Events 0.

Economic Calendar Economic Calendar Events 0. Duration: min. P: R:. Search Clear Search results, how to compute lots in forex. No entries matching your query were found. English Français 中文(繁體) 中文(简体). Free Trading Guides. Please try again. Subscribe to Our Newsletter. Market Overview Real-Time News Forecasts Market Outlook Market News Headlines. Rates Live Chart Asset classes. Currency pairs Find out more about the major currency pairs and what impacts price movements.

Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Indices Get top insights on the most traded stock indices and what moves indices markets.

Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Economic Calendar Central Bank Calendar Economic Calendar. Unemployment Rate Q1. Nationwide Housing Prices YoY JUN. F: P: R: Consumer Confidence JUN. Trading courses Forex for Beginners Forex Trading Basics Learn Technical How to compute lots in forex Volatility Free Trading Guides Live Webinars Trading Research Trading Guides.

Company Authors Contact. of clients are net long. of clients are net short. Long Short. US Dollar Technical Forecast: USD in Key Zone, how to compute lots in forex, PMI, NFP on Deck Oil - US Crude. Wall Street. As a New Retail Trader Age Rises, Heed Tales of Past Manias Gold Price Susceptible to NFP Report amid Looming Fed Exit Strategy More View more. How to Determine Lot Size for Day Trading Walker EnglandForex Trading Instructor.

Determine Your Risk Before you can select an appropriate lot size, you need to determine your risk in terms of percentages.

Find Your Stop As with any open position, a stop should be set to determine where a trader wishes to exit a trade in the event the market moves against them. Recommended by Walker England. Ensure you have the right mindset to trade with our guide.

Get My Guide. Related Articles Technical Analysis: Where to Get Started and How it Can Help How to Use Price Action to Trade New Trends Find the Markets Prevailing Trend [Webinar] html'; this.

createElement 'script' ; s. js'; s. setAttribute 'data-timestamp', new Date ; d. head d. appendChild s ; }. Market News Market Overview Real-Time News Forecasts Market Outlook.

Market Data Rates Live Chart. Calendars Economic Calendar Central Bank Rates. Education Trading courses Free Trading Guides Live Webinars Trading Research Education Archive.

DailyFX About Us Authors Contact Archive. First Name: Please fill out this field. Please enter valid First Name. Last Name: Please fill out this field. Please enter valid Last Name. E-Mail: Please fill out this field.

CALCULATING RISK - FOREX TRADING - How to Calculate Lot Size

, time: 5:45FOREX Pip Calculation | Profit and Loss - P/L Calculation

Tick size is the smallest possible change in price. Pip value for direct rates are calculated according to the following formula: Formula: Pip = lot size x tick size. Example for , GBP/USD contract: 1 pip = , (lot size) x (tick size) = $ USD. Calculating Direct Rate P/L (Profit/Loss) Calculating P/L for direct rates is 11/17/ · First, take your total trade risk (1% of your account balance), and then divide that calculated value out by the number of pips you are risking to Estimated Reading Time: 2 mins 3/21/ · On the other hand, it is possible to calculate the forex position size by using the forex lot size formula. Forex Lot/ Position Size = Risk Amount/ (Stop Loss X Value Per Pip) Calculate Forex Lot Size Effectively Using Pip ValueEstimated Reading Time: 7 mins

No comments:

Post a Comment