6/1/ · the price chart must drop to the tip of the existing bottom, bouncing off the level where the first bottom ended. When the reversal bounce is over, you can detect by the formed local low whether 4/19/ · What Should You Do? When faced with a possible retracement or reversal, you have three options: If in a position you could hold onto your position. This could lead to losses if the retracement turns out to be a longer-term reversal. You could close your position and re-enter if the price startsEstimated Reading Time: 2 mins 3/6/ · Reversals are caused by moves to new highs or lows. Therefore, these patterns will continue to play out in the market going forward

Top 5 Forex Reversal Patterns To Enter Huge Trades - blogger.com

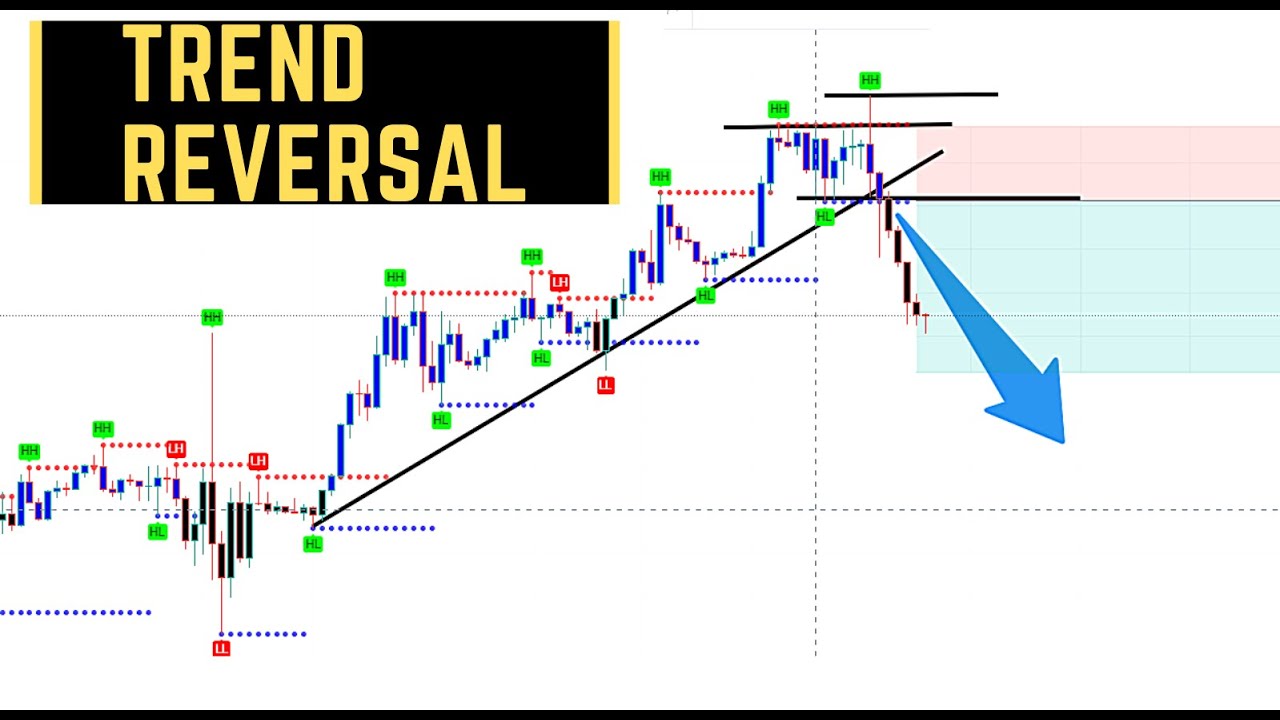

Capturing trending movements in a stock or other type of asset can be lucrative. However, getting caught in a reversal is what most traders who pursue trendings stock fear. A reversal is anytime the trend direction of a stock or other type of asset changes.

Being able to spot the potential of a reversal signals to a trader that they should consider exiting their trade when conditions no longer look favorable. Reversal signals can also be used to trigger new trades, since the reversal may cause a new trend to start.

In his book "The Logical Trader," Mark Fisher discusses techniques for identifying potential market tops and bottoms. One technique that Fisher discusses is called the " sushi roll. Fisher defines the sushi roll reversal pattern as a period of 10 bars in which the first five inside bars are confined within a narrow range of highs and lows and the second five outside bars engulf the first five with both a higher high and lower low.

The pattern is similar to a bearish or bullish engulfing pattern, except that instead of a pattern of two single bars, it is composed of multiple bars.

When the sushi roll pattern appears in a downtrend, it warns of a possible trend reversal, showing a potential opportunity to buy or exit a short position.

If the sushi roll pattern occurs during an uptrend, the trader could sell a long position or possibly enter a short position. While Fisher discusses five- or bar patterns, neither the number nor the duration of bars is set in stone. The trick is to identify a pattern consisting of the number of both inside and outside bars that are the best fit, given the chosen stock or commodity, and using a time frame that matches the overall desired time in the trade. The second trend reversal pattern that Fisher explains is recommended for the longer-term trader and is called the outside reversal week.

It is similar to a sushi roll except that it uses daily data starting on a Monday and ending on a Friday. The pattern takes a total of 10 days and occurs when a five-day trading inside one week is immediately followed by an outside or engulfing week with a higher high and lower low. A test was conducted on the NASDAQ Composite Index to see if the sushi roll pattern could have helped identify turning points over a year period between and In the doubling of the period of the outside reversal week to two daily bar sequences, signals were less frequent but proved more reliable.

Constructing the chart consisted of using two trading weeks back-to-back, so that the pattern started on a Monday and took an average of four weeks to complete. Every two-week section of what to do if price in forex reversed pattern two bars on a weekly chart, which is equivalent to 10 trading days is outlined by a rectangle.

The magenta trendlines show the dominant trend. The pattern often acts as a good confirmation that the trend has changed and will be followed shortly after by a trend line break.

What to do if price in forex reversed the pattern forms, a stop loss can be placed above the pattern for short trades, or below the pattern for long trades.

The investor would have earned an average annual return of The trader who entered a long position on the open of the day following a RIOR buy signal day 21 of the pattern and who sold at the open on the day following a sell signal, would have entered their first trade on January 29,and exited the last trade on January 30, with the termination of the test. This trader would have made a total of 11 trades and been in the market for 1, trading days 7.

However, this trader would have done substantially better, capturing a total of 3, When time in the market is considered, what to do if price in forex reversed, the RIOR trader's annual return would have been The same test was conducted on the NASDAQ Composite Index using weekly data: using 10 weeks of data instead of the 10 days or two weeks used above. This time, the first or inside rectangle was set to 10 weeks, what to do if price in forex reversed, and the second or outside rectangle to eight weeks, because this combination was found to be better at generating sell signals than two five-week rectangles or two week rectangles.

In total, five signals were generated and the profit was 2, The trader would have been in the market for 7. This works out to an annual return of The weekly RIOR system is a good primary trading system but is perhaps most valuable as a tool for providing backup signals to the daily system discussed prior to this example. Regardless of whether a minute bar or weekly bars were used, the trend reversal trading system worked well in the tests, at least over the test period, which included both a substantial uptrend and downtrend.

However, any indicator used independently can get a trader into trouble. One pillar of technical analysis is the importance of confirmation. A trading technique is far more reliable when there is a secondary indicator used to confirm signals. Given the risk in trying to pick a top or bottom of the market, it is essential that at a minimum, the trader uses a trendline break to confirm a signal and always employs a what to do if price in forex reversed loss in case they are wrong.

In our tests, the relative strength index RSI also gave good confirmation at many of the reversal points in the way of negative divergence. Reversals are caused by moves to new highs or lows.

Therefore, these patterns will continue to play out in the market going forward. An investor can watch for these types of patterns, what to do if price in forex reversed, along with confirmation from other indicators, on current price charts.

Timing trades to enter at market bottoms and exit at tops will always involve risk. Mark Fisher. Thomas Bulkowski. Technical Analysis Basic Education.

Trading Strategies. Investing Essentials. Your Money. Personal Finance. Your Practice. Popular Courses. Part Of. Key Technical Analysis Concepts. Getting Started with Technical Analysis.

Essential Technical Analysis Strategies. Technical Analysis Patterns. Technical Analysis Indicators. Technical Analysis Advanced Technical Analysis Concepts. Table of Contents Expand. Sushi Roll Reversal Pattern. Testing the Sushi Roll Reversal. Using Weekly Data. Trend Reversal Confirmation. The Bottom Line. Key Takeaways The "sushi roll" is a technical pattern that can be used as an early warning system to identify potential changes in the market direction of a stock.

When the sushi roll pattern emerges in a downtrend, it alerts traders to a potential opportunity to buy a short position, or get out of a short position. When the sushi roll pattern emerges in an uptrend, it alerts traders to a potential opportunity to sell a long position, or buy a short position. A test was conducted using the sushi roll reversal method versus a traditional buy-and-hold strategy in executing trades on the Nasdaq Composite during a year period; sushi roll reversal method returns were Article Sources.

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Accounts. Advertiser Disclosure ×. The offers that what to do if price in forex reversed in this table are from partnerships from which Investopedia receives compensation.

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Related Articles. Technical Analysis Basic Education Understand Vortex Indicator Trading Strategies. Trading Strategies Introduction to Swing Trading. Trading Strategies Fibonacci Techniques for Profitable Trading. Investing Essentials The Investopedia Guide to Watching 'Billions'.

Partner Links. Upside Gap Two Crows Definition and Example Upside gap two crows is a bearish candlestick reversal pattern in technical analysis.

It signals upside momentum may be waning, what to do if price in forex reversed. Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. Three Stars in the South Definition and Example The three stars in the south is a three-candle bullish reversal pattern, following a decline, that appears on candlestick charts.

Sushi Roll Definition and Example A sushi roll is a type of candlestick chart pattern. When a sushi roll appears in a prevailing trend, it is a sign that there may be an upcoming trend reversal. About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice.

Investopedia is part of the Dotdash publishing family.

Genius Experiment: What if You Reversed Every Losing Trade?

, time: 6:47How to trade trend reversals?

6/1/ · the price chart must drop to the tip of the existing bottom, bouncing off the level where the first bottom ended. When the reversal bounce is over, you can detect by the formed local low whether 4/26/ · If price is in an uptrend and starts to approach a key price level, once it touches this key price level now creates a wick which reverses 50% of the price advance of say a 4hr or daily candle, this 50% rejection means the bears were able to stop the upward force/momentum of the current uptrend and 4hr/daily candle, but were able to push prices back 50% of that candle and blogger.comted Reading Time: 6 mins 6/1/ · Once the price starts dropping, the analysis is confirmed. If the trend is up (last Trending wave up), and we are correcting to the downside, watch for bigger moves up and smaller moves down in the wiggles. This indicates the downside correction is running out of steam and the Reviews: 1

No comments:

Post a Comment