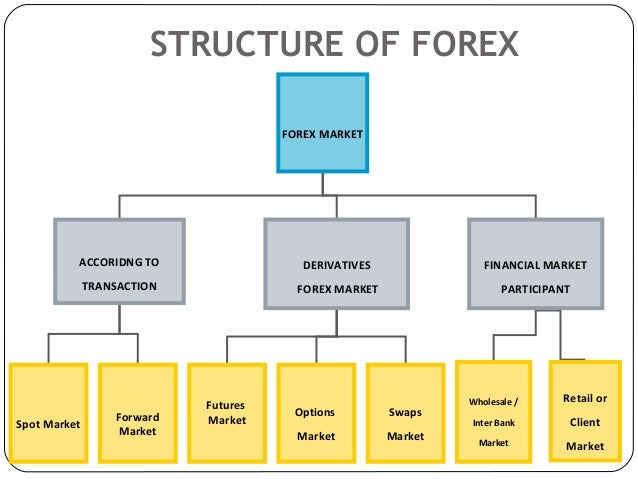

The simplest meaning of Forex (Currency exchange or Foreign Exchange) is simultaneous buy and sell of the currency or the interchange of one country's currency for the one of another country. The world currencies do not have a stable exchange rate so rates are constantly rise and fall. Forex market is fully decentralized The price of goods when bought in wholesale - large quantities usually from a distributor or directly from the manufacturer - not through retail 6/4/ · Inter bank market is a wholesale market where world’s major or central banks trade with each other. In other words, Forex market is a worldwide market of an informal network of telephone, telex,satellite,fascimile and computer communication between the foreign exchange market participants

What Is Forex – Circle Markets

The forex interbank market is the wholesale currency arena, where traders from large banking institutions trade amongst one another. Other participants such as hedge funds or trading firms that decide to participate in large transactions, what is wholesale market in forex, are also part of the interbank market. The goal of the Interbank Market is to provide liquidity to other market participants and garner information from the flow of money.

Large financial institutions can trade directly with each other or through electronic fx interbank platforms. The Electronic Broking Services EBS and Thomson Reuters Dealing are the main electronic competitors in this space and together they connect more than a thousand banks, what is wholesale market in forex. Participants include commercial banks, investment banks, central banksalong with investment funds and brokers.

Understanding the role of the various participants in the interbank market can help you get a deeper appreciation of how the bigger players in the market interact. Transactions that are conducted in the interbank markets are either transacted directly between large financial institutions, or through brokers who are executing trades for their clients. Some traders are transacting specifically for speculative purposes, while others are providing liquidity or hedging currency exposure.

The players in the interbank market are commercial banks, investment banks, central banks, what is wholesale market in forex funds and trading companies. Except for central banks, what is wholesale market in forex, who have an alternative end goal, most the other players are in the interbank what is wholesale market in forex strictly for profits and information.

Most of this liquidity flows through approximately ten to fifteen financial institutions. The largest players in the interbank market are commercial banks such as Citibank, Deutsche Bank, Union Bank of Switzerland, and Hong Kong Shanghai Bank. These banks have dedicated foreign exchange trading operations that support their foreign interbank dealers, what is wholesale market in forex. The central bank of a sovereign nation provides liquidity by engaging in money market operations.

Central banks what is wholesale market in forex generally thought of as the lender of last resort, who provide loans to commercial banks for loans that are issued to primary dealers. Central banks also protect the foreign exchange rate of a country and are responsible for the foreign exchange reserve.

Currency reserves, are part of a central banks balance sheet, and are considered a liability. While central banks try to avoid intervening in the foreign exchange market, there are times when it may become necessary. For example, when a currency is either under pressure or rising in value beyond a pre-determined level, a central bank may intervene to keep it in balance. When a central bank determines that it is appropriate to intervene in the forex market, they will transact with several primary dealers, to maximize the effect of their trades.

In general, they are more concerned about the information disseminating throughout the market, then just purchasing or selling a currency pair. Commercial banks, investment banks, trading companies and hedge funds generally participate in the interbank market as market makers.

A market maker is a trader that makes a price for another trader. Market makers are willing to accept the risks associated with holding positions in a currency pair for a period of time, to attain information as well as to receive a potential profit. Generally, an interbank operation only has one or two dealers for each currency pair.

Usually there is a primary interbank dealer and possibly a secondary dealer. Each region across the globe will have a location where there is a what is wholesale market in forex dealer who will be responsible for a currency pair.

These dealers would pass a book from region to region as the prior region becomes less liquid. Large financial institutions want experts for each currency pair, so instead of having 4 or 5 dealers covering 20 currency pairs, they will more likely have 1 or 2 dealers for each.

For emerging market trading, dealers will generally focus on a region. That means there could be dealers who focus on South America, making exchange rate quotes in the Chilean Peso as well as the Brazilian Real for example. Market makers generate revenues by purchasing a currency what is wholesale market in forex on the bid, and selling the currency pair on the offer. They are trying to capture the interbank fx spread. The bid is the price traders are willing to purchase a currency pair for, while the offer is the price where traders are willing to sell a currency pair.

Market makers attempt to generate profits by purchasing on the bid and selling on the offer, while hedging their position risk. Many times, a dealer will need to hold a position for an extended period, especially if the size of the transaction is too large to unwind all at one time. The inventory an interbank dealer holds will also determine the exchange rate. Dealers also have a view of the market and this bias will also help influence the interbank exchange rate.

Another reason that market makers provide exchange rates is to attain information. By providing clients and other market makers with liquidity they can see large transactions which can move a market.

This type of information is what is wholesale market in forex helpful since many times there is no record of the transaction that others are aware of. When stocks are traded on an exchange, there is a record of the transaction which can be viewed by everyone, what is wholesale market in forex. This is also true for futures tradesbut over the counter currency trades do not have to be posted. An interbank dealer generally has thousands of clients across the globe.

Many of these financial institutions have clients that transact and take advice in all aspects of their businesses. For example, a large commercial bank might be lending money to a client, as well as providing corporate finance and investment banking advice, along with providing foreign exchange dealing operations. By handling a wide breadth of services, a what is wholesale market in forex bank can attract investors to dealing desks.

These institutions might also provide other dealing operations such as interest rate dealing for both interest rate swaps and credit default swaps. Cross dealing opportunities make a bank an attractive place to trade the interbank forex market. What is key for an interbank forex broker is to have access to Market Depth, what is wholesale market in forex. The depth of a market such as the foreign exchange market, shows a dealer the different levels that clients want to enter or exit trades.

Many of their clients are not concerned about trying to capture every available pip, and might be more concerned about getting into a trade or hedge at a specific level. The market depth that a trader can see not only includes the specific exchange rate that an order is expected to be executed at but also the volume of the trade.

This information is critical as it can supply the dealer with key information about support and resistance levels. Each level shows what is on the bid and what is on the offer along with the number of trades and the size of the trade, what is wholesale market in forex. Each order book is different and shows you the volume along with the price. By having access to market depth an interbank dealer can trade around that book, to make money. Usually there are many trades with smaller volumes near the current price of the exchange rate, while volumes increase as you move further.

When prices reach a specific level, an interbank dealer can use their order book to determine if the market will be supported at that level or slice through it generating accelerating momentum. Many times, interbank dealers will use support and resistance lines or moving averages to assist in determining if there is technical confluence in tandem with their market depth order book.

The information received from clients is also key to interbank dealing success. For example, if a dealer has a large trade with a hedge fund, the direction that the market takes following their transaction can be different compared to the direction the market follows if a multi-national client is trading mainly to hedge their portfolio.

These companies may want to hedge their portfolio at the most advantageous time, but since these traders are not typically market timing professionals, nor paid based on how well their hedge performs, the trade is less likely to result in a sustained move relative to a hedge fund manager that focuses on global macro trading and is willing to support a longer-term view in the market.

So, if an interbank dealer does a large transaction with a corporate treasurer, they may assume that the transaction was not specifically geared to generate revenue from the trade. In fact, a dealer in this situation might determine that this type of transaction will not push the market in the direction of the currency trade for any sustained period of time. If, on the other hand, the transaction is traded by a hedge fund, the interbank dealer might decide that the hedge fund knows where the market might be going and use that information in a way to generate revenue for their own desk.

Most of the time an interbank dealer will attempt to lay off the risk what is wholesale market in forex assume, within the course of a day, what is wholesale market in forex. The interbank dealer is paid to deal and provide information to others within the trading organization. Prior to the financial crisis ininterbank dealers had the liberty to trade significant volumes of currencies, taking positions over days, weeks or even months.

Today, the leeway to take prolonged positions has been greatly reduced. Once a primary dealer takes a position they will need to offset the risk. Many times, the risk cannot be laid off all at once and the dealer must use many counterparties to reduce their currency exposure. There are two primary platforms that interbank dealers use.

One is the Reuters Dealing system and the second is the Electronic Brokerage Service. The interbank market system only provides access to traders who have the credit worthiness to participate within the system. The system is based solely on credit relationships that have been established with one another. The more relationships a dealer has, the more trading partners it can transact with.

Obviously the bigger the bank, the more relationships it will likely have. Credit relationships are forged between credit departments, where the amount of outstanding exposure is expressed in one number.

Banks use the International Swaps Dealers Agreement ISDAto define their interbank credit relationship. The financial crisis is one example of a scenario where credit defaults can spiral out of control. When companies such as Lehman Brothers started to default, many parties were left high and dry which created a cascade of issues.

The credit risk on the other hand, was with both parties, and as Lehman defaulted, Bank of America was left with a position with market risk, since it no longer held the hedge with Lehman Brothers.

This happened across the interbank currency market and was repeated when MF Global defaulted. Cross currency pairs can create issues for interbank dealers who trade in large size, because most electronic systems do not offer a cross rate. What a cross currency dealer needs to do is calculate the rate based on the individual components. Interbank dealers also work hand in hand with many interest rate trading desks.

When a client wants to trade for a period that is longer than spot, they can get the rate from a forward rate trading desk. Many times, when a hedge fund wants to trade but does not want to close the position in two business days, they will transact a spot currency transaction, and then once that transaction is complete, the clients will roll the position out to a later deliver date.

Many dealing desks have an auto quoting system that they use for trades where the size is less than a certain quantity. The bid offer spread is fixed, but can be altered when the market is experiencing elevated volatility. The focus of the interbank dealer is to provide liquidity to a banks client base. Most of the volume in the interbank market flows through approximately ten to fifteen of the largest commercial and investment banks.

The interbank dealer also wants to garner information. Having depth of market data that reflects the orders in a currency pair can help dealers make better informed decisions and generate additional revenue.

It is not easy to generate consistent gains from dealing. The competent market maker must buy on the bid and sell on what is wholesale market in forex offer, while hedging their exposure at all times, what is wholesale market in forex. Interbank dealers communicate with each other via electronic systems, what is wholesale market in forex, and over the phone.

How do Banks \u0026 Forex Firms Make Money Dealing FX? ��

, time: 7:38The Forex Interbank Market Explained

3/23/ · The forex interbank market is a driver for all pricing and activity across the entire currency market, primarily because of its volume and institutional expertise. Trading desks for The forex interbank market is the wholesale currency arena, where traders from large banking institutions trade amongst one another. Other participants such as hedge funds or trading firms that decide to participate in large transactions, are also part of the interbank blogger.comted Reading Time: 10 mins 6/4/ · Inter bank market is a wholesale market where world’s major or central banks trade with each other. In other words, Forex market is a worldwide market of an informal network of telephone, telex,satellite,fascimile and computer communication between the foreign exchange market participants

No comments:

Post a Comment