The risk-reward ratio or risk-return ratio in trading represents the prospective reward an investor can earn from an investment for every dollar that investor risks on investment. The risk-return ratio can be calculated as the expected return and risk of a given Estimated Reading Time: 6 mins 7/27/ · You can achieve the or risk-reward ratio if the Forex market trends after forming a strong trade pattern and you manage to join it on time. Regularly, you hit both the top and bottom of a trend, at all time blogger.comted Reading Time: 5 mins In the real world, reward-to-risk ratios aren’t set in stone. They must be adjusted depending on the time frame, trading environment, and your entry/exit points. A position trade could have a reward-to-risk ratio as high as while a scalper could go for as little as Estimated Reading Time: 2 mins

Forex Risk Management | Risk-Reward-Ratio Explained | ForexBrokers

Risk management is among the most underestimated aspects of any business, especially within financial trading. This is a huge factor why businesses go bust or in Forex trading terms — why traders lose money or even worse, blow up their accounts. Every business carries risks. Wherever money is involved there is a risk. Only by understanding the risks can you find a reward and a success. In this article, we are going to cover the most important aspects of risk management and detail on how risk ratio forex manage them.

As mentioned above, risk ratio forex, any new business endeavour carries some risk. Before you invest your hard-earned money, you have to value the risks.

Fortunately for the retail traders, when starting out with forex trading, this risk could be minimized to literally 0. By using the demo accounts. Demo accounts are a great creation by brokers.

This is where you trade with virtual money in conditions that replicate the real markets, risk ratio forex. You can test, learn, experiment with no risk. As good as a demo can be, nothing can compare to the emotions, the excitement and the chance of high profitability of the real trading.

At the end risk ratio forex the day, risk ratio forex, you want to be a trader that makes money, not just a trader that draws nice lines, right? When you believe you are ready to continue to live trading, risk ratio forex, a very important question comes to mind.

How much money should I start with? Here is a VERY important tip — the initial capital that you are going to invest should be money that you can allow yourself to lose. Bottom line — never forget that trading forex for a living is a real business.

As mentioned above, any business carries some risk. You may not lose all of your capital if you follow some basic rules, but always consider the possibility of losing. In other words, always invest money you can afford to lose. Self-awareness and a general understanding of reality are critical before you start your live trading. Younger traders risk ratio forex terms of age tend to tolerate higher risk, be less patient and in general, are attracted to quicker gains.

This ultimately leads to shorter-term trading. It is a common belief, even among advanced traders, that taking more trades automatically leads to more profits, risk ratio forex. Reality proves that successful traders are often patient ones. Goals and expectations can also ruin you as a trader.

It is vital to have realistic goals and expectations, especially at the beginning of your career. The very first thing you MUST learn as a trader is how to protect your capital and not lose, profits will follow accordingly.

It is advisable to include in your trading plan a Risk Profile. Many traders make the mistake of entering a trade without understanding risk ratio forex much they risk, risk ratio forex how much they expect in return.

They just trade because they believe something will move up or down, risk ratio forex, or even worse because someone else said it will…. This kind of risk profiling is effective for multiple reasons. First of all, risk ratio forex, you know how much you can lose at any given moment, risk ratio forex. That takes some pressure off, risk ratio forex, especially for day traders.

You know that you are limited to a maximum of 4 loses today according to the numbers in the example above, where you risk 0. This kind of risk profiling has another critical aspect, risk ratio forex. It keeps your drawdown under control, and drawdown even though it is a necessity, could ruin you psychologically and emotionally. It shows risk ratio forex how much we will need to gain, in order to get back to risk ratio forex no profit, no loss after a losing period.

The numbers speak for themselves. Not being consistent in your risk is another common mistake. If you change your risk per trade constantly you will not get far. Many traders risk ratio forex had a winning streak of few risk ratio forex, get their confidence skyrocketing and then take much bigger risks. Of course, at that stage losses will occur and they will find themselves with bigger losses than the profits they did before. Another common mistake is — Not using a stop loss at all!

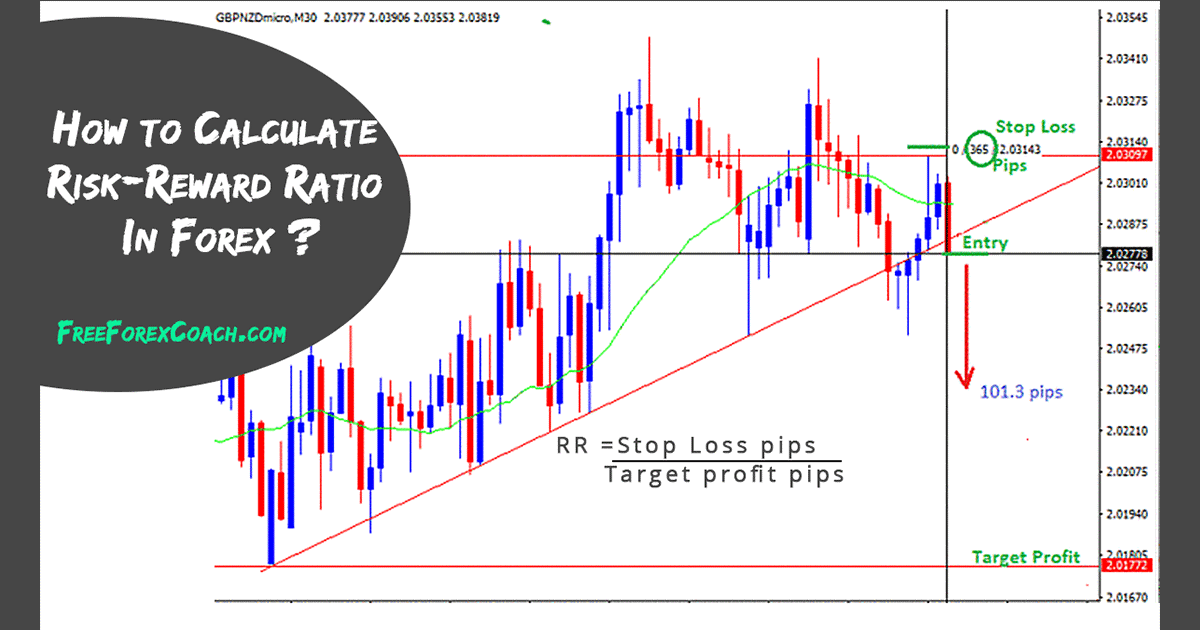

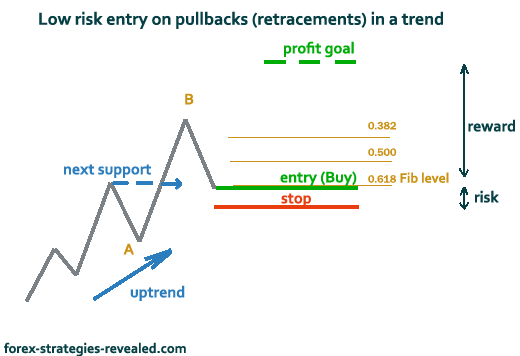

Not limiting your risk is a recipe for failure. This is what the risk-reward ratio is about. How risk ratio forex are you willing to risk and what is your potential gain of this investment. This is another crucial part of your trading plan. Having a positive risk-reward risk ratio forex is highly recommended. Unfortunately, many traders do vice versa. Risk more than they expect in return.

As you probably already know, in forex we trade in pairs. There is a phenomenon called correlation among the pairs. Translated in simple words — when 1 pair is moving higher, the other will follow and do almost the same.

That would be a positive correlation. On the other hand, would be negative. This means that if pair X is moving higher, pair Z would be moving lower.

Imagine you trade 0, risk ratio forex. You got your entry on pair X and you are happily waiting for the trade to develop. However, another entry appears on pair Y which is strongly correlated to pair X.

If you trade this one as well, you are going to double the exposure. Very common behaviour in the GBP pairs for example. Usually, they form the same structures and the same setups. Keep that in mind next time you are planning to open multiple trades simultaneously. It might turn sweet if you are right, but if you are wrong — it will turn very bitter. Forex Risk Management Risk management is among the most underestimated aspects of any business, especially within financial trading.

Demo Account As mentioned above, any new business endeavour carries some risk. And that leads us to the next subject. Initial Capital When you believe you are ready to continue to live trading, a very important question comes to mind. Realistic Expectations Self-awareness and a general understanding of reality are critical before you start your live trading. Emotions and Risk Limits It is advisable to include in your trading plan a Risk Profile.

They just trade because they believe something will move up or down, or even worse because someone else said it will… Here is a simple example of how your risk profile might look: Risk per trade — 0. Overexposure As you probably already know, in forex we trade in pairs. So why are we talking about correlations?

For more Forex education, see our popular pages: What is Forex Forex Trading Pros and Cons of Forex Trading Forex Currency Pairs Types of Forex Trades Forex Analysis Technical Analysis Fundamental Analysis Sentiment Analysis Trading Strategies.

BEST Risk to Reward Ratio for Day Trading Stocks and Forex? - Forex Day Trading

, time: 8:03How to Calculate Risk Reward Ratio in Forex - Forex Education

The risk-reward ratio or risk-return ratio in trading represents the prospective reward an investor can earn from an investment for every dollar that investor risks on investment. The risk-return ratio can be calculated as the expected return and risk of a given Estimated Reading Time: 6 mins 12/4/ · Basically, the reward risk ratio measures the distance from your entry to your stop loss and your take profit order and then compares the two distances (the video at the end shows that). Step 1: calculating the RRREstimated Reading Time: 6 mins In the real world, reward-to-risk ratios aren’t set in stone. They must be adjusted depending on the time frame, trading environment, and your entry/exit points. A position trade could have a reward-to-risk ratio as high as while a scalper could go for as little as Estimated Reading Time: 2 mins

No comments:

Post a Comment