Dec 05, · Forex is commonly traded in specific amounts called lots, or basically the number of currency units you will buy or sell. A “ lot” is a unit measuring a transaction amount. When you place orders on your trading platform, orders are placed in sizes quoted in lots. It’s like an egg carton (or egg box in British English).Estimated Reading Time: 5 mins Apr 24, · How Does Forex Trading Affect the Economy? Forex market trades more than USD trillion each day and is known as the largest financial market in the world. Currency trading works in the same manner as the stocks does; you buy shares in stock as you buy currency in Forex, for the purpose of trading and generating blogger.comted Reading Time: 6 mins Dec 16, · The primary way in which central banks affect the forex market is by changing interest rates. If interest rates are high, people borrow less, if interest rates are low people borrow more. Countries which rely on exports prefer their currency to be cheap. This is because it allows them to export more which is better for their economy

How Does Forex Trading Affect the Economy? - Trade Live

By Rekhit Pachanekar. Forex market trading is not difficult if you have a basic idea on when the foreign exchange of a country will change, how lot affect in forex trading. Over a period of time, it has been realised that the forex market can be affected by certain macroeconomic factors. In this article, I would take you through some factors that affect the forex market trading. To read about the basics and essentials of Forex market trading, you can visit this article. An economy grows when the government willingly takes steps to improve the living standard of its populace.

Thus, a stable government may be the first sign of an investor-friendly country. It means the economy has fewer roadblocks and higher chances to grow. How it relates to forex market trading: A trader might buy the currency of a country whose political conditions are stable. News of Brexit led to a dive how lot affect in forex trading the value of the GBP when how lot affect in forex trading to the US Dollar. No surprises there.

How it relates to forex market trading: An investor would seek to buy a currency where the inflation rates are lower. As you can see in the graph, as the inflation rose in Zimbabwe, how lot affect in forex trading, its currency value devalued aggressively. Now, five kids come to you with 10 rupee notes demanding a pen, but the problem here is that you only have three pens. One scenario is that you start a bidding war and the one who needs it the most will bid double or triple the price of the pen.

But wait! There is another way, how lot affect in forex trading. So you tell them to deposit the 10 rupees with you and when you get new stock, you will give it to them.

To sweeten the deal, you say that you will give them 1 rupee along with the pen. The two kids agree and your problem is solved. Granted, this is an oversimplification, but this is the logic whenever the central bank decides that the inflation rate is growing out of control, it steps in to control it by increasing the interest rates and thus, rein in the amount of currency in the market.

An increase in interest rates is a good sign for investors as the currency rate increases due to the increased interest rate for the currency. How it relates to forex market trading: An investor will gravitate towards the economy with higher interest rates as they increase their rate of return. This increases the demand for the currency and in turn, increasing the exchange rate. The RBI has increased the interest rate to stem the fall of the Rupee.

How it relates to forex market trading: An investor may see the government debt trend over the years to determine if it is a sound decision to invest in the currency of the country. One of the reasons for the weakening of the Indian rupee is the government debt which has not decreased due to the rise in oil prices. Terms of Trade can be addressed as the ratio of Export Prices To Import Prices. This means its currency value will be greater than another country whose Terms of trade are lower in comparison.

How it relates to forex market trading: An investor may like to invest in a country whose exports are greater than their imports. This is not exactly a measurable factor. If there is speculation that the currency rate will increase, other investors will demand how lot affect in forex trading of the currency and its currency rate increases further.

The same holds true for the other side, how lot affect in forex trading. How it relates to forex market trading: The trick here is to how lot affect in forex trading a bandwagon effect and make sure you are out of it before the effect wears away. Inwith low lending rates in the housing market in the US, there was speculation that property prices would rise and this, in turn, would increase the value of the dollar.

You can get a rough idea of how the economy is doing by seeing the trend of the capital markets. A lengthy dive of the stock market usually indicates low confidence from the investors and thus, can be useful for predicting the currency rate compared to the other country.

How it relates to forex market trading: If the capital markets show an uptrend, it means the currency rate will increase. Every country releases employment rates periodically.

This is another indication of how well the economy is doing. A high unemployment rate means the economy is not growing in line with the population of if the economy has stagnated.

How it relates to forex market trading: A high unemployment how lot affect in forex trading could lead to a depreciation in the currency value and thus decrease the forex rate of that currency, how lot affect in forex trading. After the US non-farms payroll report was released in September with an upbeat tone, the US Dollar index DXY ie the performance of the US Dollar compared to a basket of foreign currencies increased from The monetary and fiscal policy of a country will give you a good idea if it is investor friendly or not.

Thus, if the government has plans and incentives in place to attract foreign capital, investors may flock to this country and increase the demand for the particular currency. After the budget of was presented, in the domestic market, BSE and NSE saw a downward trend and it was estimated that collectively, 4.

When it comes to forex market trading, the rupee saw a 44 paise fall when compared to the US Dollar. These are a few factors which every investor should know before starting foreign exchange trading. After going through this article about various factors that affect forex trading, not only do you know the basics of Forex trading Strategybut you have also understood how certain factors affect trading in the forex market.

But, how lot affect in forex trading, why stop here? You can enroll for this forex trading strategy course on Quantra and learn to create a value strategy based on fundamentals such as Real Effective Exchange Rate REER. Disclaimer: All investments and trading in the stock market involve risk.

Any decisions to place trades in the financial markets, including trading in stock or options or other financial instruments is a personal decision that should only be how lot affect in forex trading after thorough research, including a personal risk and financial assessment and the engagement of professional assistance to the extent you believe necessary.

The trading strategies or related information mentioned in this article is for informational purposes only. By Rekhit Pachanekar Forex market trading is not difficult if you have a basic idea on when the foreign exchange of a country will change.

But how would you know that? Here are the 9 Factors Affecting Forex Market Trading The Political Landscape An economy grows when the government willingly takes steps to improve the living standard of its how lot affect in forex trading. Example in the world of Foreign exchange trading: News of Brexit led to a dive in the value of the GBP when compared to the US Dollar.

Example in the world of Foreign exchange trading: As you can see in the graph, as the inflation rose how lot affect in forex trading Zimbabwe, its currency value devalued aggressively. Example in the world of Foreign exchange trading: The RBI has increased the interest rate to stem the fall of the Rupee. How it relates to forex market trading: An investor may see the government debt trend over the years to determine if it is a sound decision to invest in the currency of the country Example in the world of Foreign exchange trading: One of the reasons for the weakening of the Indian rupee is the government debt which has not decreased due to the rise in oil prices.

Terms Of Trade Export Prices To Import Prices Ratio Terms of Trade can be addressed as the ratio of Export Prices To Import Prices. Example in the world of Foreign exchange trading: Inwith low lending rates in the housing market in the US, there was speculation that property prices would rise and this, in turn, would increase the value of the dollar. The Capital Market You can get a rough idea of how the economy is doing by seeing the trend of the capital markets.

Example in the world of Foreign exchange trading: After the US non-farms payroll report was released in September with an upbeat tone, the US Dollar index DXY ie the performance of the US Dollar compared to a basket of foreign currencies increased from Example in the world of Foreign exchange trading: After the budget of was presented, in the domestic market, BSE and NSE saw a downward trend and it was estimated that collectively, 4.

Share Article:. Oct 03, how lot affect in forex trading, Aroon Indicator: How To Use It For Cryptocurrency Trading.

Our cookie policy. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies.

Read more.

What is the spread - Forex Training Courses - Plan B Trading

, time: 5:55How to Trade Forex on News Releases

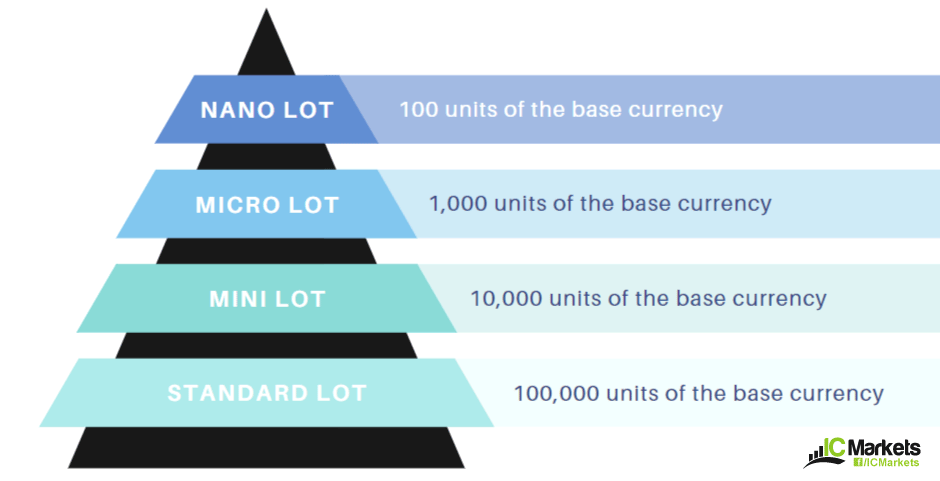

Dec 05, · Forex is commonly traded in specific amounts called lots, or basically the number of currency units you will buy or sell. A “ lot” is a unit measuring a transaction amount. When you place orders on your trading platform, orders are placed in sizes quoted in lots. It’s like an egg carton (or egg box in British English).Estimated Reading Time: 5 mins May 22, · In the context of forex trading, a lot refers to a batch of currency the trader controls. The lot size is variable. Typical designations for lot size include standard lots, mini lots, and micro lots. 1 It is important to note that the lot size directly impacts and indicates the amount of risk you're blogger.comted Reading Time: 4 mins Dec 16, · The primary way in which central banks affect the forex market is by changing interest rates. If interest rates are high, people borrow less, if interest rates are low people borrow more. Countries which rely on exports prefer their currency to be cheap. This is because it allows them to export more which is better for their economy

No comments:

Post a Comment