10/10/ · In American forex calendar investors await the CPI m/m and the Core CPI m/m at GMT, Initial Jobless Claims and Continuing Jobless Claims also to be released at GMT. The New Housing Price Index m/m is the main event for Canada today due at blogger.comted Reading Time: 1 min 3/8/ · So how does CPI affect the economy? Often, higher inflation will translate to higher benchmark interest rates being set by policymakers, to help dampen the economy and subdue the inflationary blogger.comted Reading Time: 5 mins 2/20/ · The short answer is yes. CPI figures enormously impact the value of currencies as well as the relationship of a one currency to another. Currency traders always keep a close watch on not only monthly CPI figures from a country, but also estimates by experts about what the monthly CPI will be

CPI m/m - statistical data from the United States

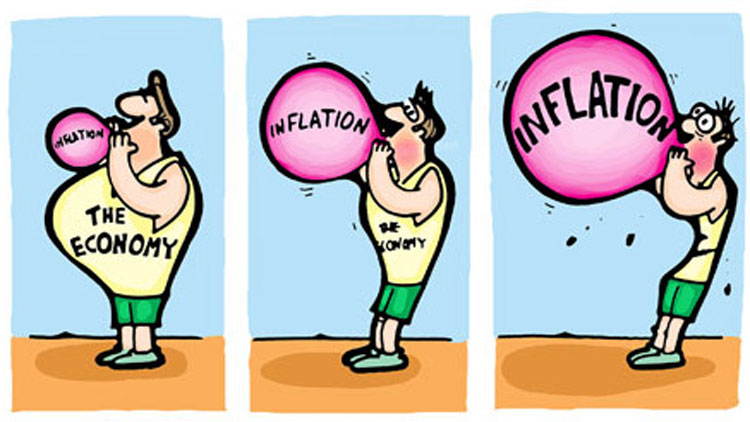

The Consumer Price Index, better known by the acronym CPI, is an important economic indicator released on a regular basis by major economies to give a timely glimpse into current growth and inflation levels. CPI is calculated by averaging price changes for each item in a predetermined basket of consumer goods, including food, energy, and also services such as medical care.

It is a useful indicator for forex traders due to its aforementioned effect on monetary policy and, in turn, how does cpi m m affect the forex market, interest rates, which have a direct impact on currency strength.

The full utility of knowing how to interpret CPI as a forex trader will be explored below. Read more on how interest rates impact the forex market. CPI release dates usually occur every month, but in some countries, such as New Zealand and Australia, quarterly. The US Bureau of Labor Statistics has reported the CPI monthly since The following table shows a selection of major economies and information about their CPI releases.

Understanding CPI data is important to forex traders because it is a strong measure of inflation, which in turn has a significant influence on central bank monetary policy, how does cpi m m affect the forex market.

So how does CPI affect the economy? Often, how does cpi m m affect the forex market, higher inflation will translate to higher benchmark interest rates being set by policymakers, to help dampen the economy and subdue the inflationary trend. Conversely, countries with lower interest rates often mean weaker currencies.

Also, CPI data is often recognized as a useful gauge of the effectiveness of the economic policy of governments in response to the condition of their domestic economy, a factor that forex traders can consider when assessing the likelihood of currency movements. The CPI can also be used in conjunction with other indicators, such as the Producer Price Indexfor forex traders to get a clearer picture of inflationary pressures.

When using CPI data to influence forex trading decisions, traders should consider the market expectations for inflation and what is likely to happen to the currency if these expectations are met, or if they are missed. Similar to any major release, it may be beneficial to avoid having an open position immediately before. Traders might consider waiting for several minutes after the release before looking for possible trades, since forex spreads could widen significantly right before and after the report.

Below is a chart displaying the monthly inflation rates for the US. For the latest month, expectations are set at 1. If CPI is released higher or lower than expectations this news event does have the ability to influence the market. Source: TradingEconomics. US Bureau of Labor Statistics. If CPI is released away from expectations, it is reasonable to believe this may be the catalyst to drive the Index to fresh highs, or to rebound from resistance.

Chart to show movement in the US Dollar Index. Source: TradingView. As can be observed in the example above, as inflation rose during the first half ofthe US Dollar Index went up accordingly.

As a result, the dollar struggled and weakened against a basket of other currencies. Not every fundamental news release works out through price as expected. Once the CPI data has been released and analy z ed, traders should then look to see if the market price is moving through or rebounding off any areas of technical importance.

Make sure you bookmark our economic calendar to stay tuned in to the latest CPI data released by a range of countries, and stay abreast of all the DailyFX news and analysis updates.

Also, reserve your place at our Central Bank Weekly webinar series to learn about news events, market reactions, and macro trends. For more information on inflation and its impact on forex decisions, take a look at our article Understanding Inflation for Currency Trading. Source link. Save my name, email, and website in this browser for the next time I comment.

For updates and exclusive offers, enter your e-mail below. CryptoCurrency USD Change 1h Change 24h Change 7d Bitcoin 34, 0. Home Cryptocurrency Forex Stocks How does cpi m m affect the forex market Contact Forum.

Join the larget crypto conference of in Dubai. What is CPI and why does it matter to forex traders? CPI release dates CPI release dates usually occur every month, but in some countries, such as New Zealand and Australia, quarterly. What to consider when trading forex against CPI data When using CPI data to influence forex trading decisions, traders should consider the market expectations for inflation and what is likely to happen to the currency if these expectations are met, or if they are missed.

com As can be observed in the example above, as inflation rose during the first half ofthe US Dollar Index went up accordingly. Read more on CPI, inflation and forex Make sure you bookmark our economic calendar to stay tuned in to the latest CPI data released by a range of countries, and stay abreast of all the DailyFX news and analysis updates.

Banks Forex Market Stocks USD. CFA Institute Enterprising Investor Next Post El Salvador Offers No Capital Gains Tax, Permanent Residence to Crypto Entrepreneurs — Bitcoin News. Related Posts In Investments.

Paul Smith, CFA: Looking Back and Looking Ahead. In Stocks. In Forex. Banks Resume Capital Distribution Following Federal Reserve Stress Test Results. Leave how does cpi m m affect the forex market Reply Cancel Reply. Subscribe To Newsletter For updates and exclusive offers, enter your e-mail below.

Hot Posts. Pump and Dumps Schemes and How to Trade the Setups. March 21, By Admin. The Rise of Zoom- How to Spot Stocks with Growth Potential. March 28, By Admin. Top 10 Value Stocks to Invest in Now. April 2, By Admin. Australian How does cpi m m affect the forex market of Statistics. National Bureau of Statistics of China. Federal Statistical Office of Germany. Monthly, yearly. Ministry for Statistics and Programme Implementation.

Monetary Policy Committee.

CPI, PPI \u0026 Inflation (Economics Crash Course)

, time: 10:56When is the US CPI and how could it affect EUR/USD?

1/16/ · This index affects interest rates, tax benefits, and is used in the adjustment of wages and government benefits, etc. As a measure of inflation, the CPI has a strong impact on the pound sterling quotes. The indicator growth may have a positive effect on the British pound 1/11/ · Consumer Price Index (CPI) m/m shows changes in average prices for a consumer basket of goods and services in the given month compared to the previous one. The index shows how prices change from the consumer perspective. In other words, it allows estimating changes in the cost of living. Goods and services included in the CPI calculation basket are 3/8/ · So how does CPI affect the economy? Often, higher inflation will translate to higher benchmark interest rates being set by policymakers, to help dampen the economy and subdue the inflationary blogger.comted Reading Time: 5 mins

No comments:

Post a Comment