Dec 07, · Forex candlesticks provide a range of information about currency price movements, helping to inform trading strategies ; Trading forex using candlestick charts is Author: David Bradfield Nov 06, · Forex Candlesticks. Forex Candlesticks / How to Read them? For any technical trader looking to gain a deeper understanding of how to read forex charts in general. I think learning to read candlestick charts is a great starting point. In the 18th century, Candlestick charts were invented and created, as you may already blogger.comted Reading Time: 2 mins Jan 15, · Trading graphs are an essential tool in the technical trader’s toolbox.. They allow traders to perform technical analysis and predict future price-movements by analysing past price-action of a financial instrument. Price-charts are used in almost all financial markets, such as the stock market, Forex market or commodities blogger.comted Reading Time: 9 mins

Understanding a Candlestick Chart

Candlestick trading is not something that I am actively how do i read candlestick for forex trading with. My personal style of trading is more based upon price breakouts or using various combinations of indicators in trading robots. But there are tons of traders out there who trade and swear by these price patterns.

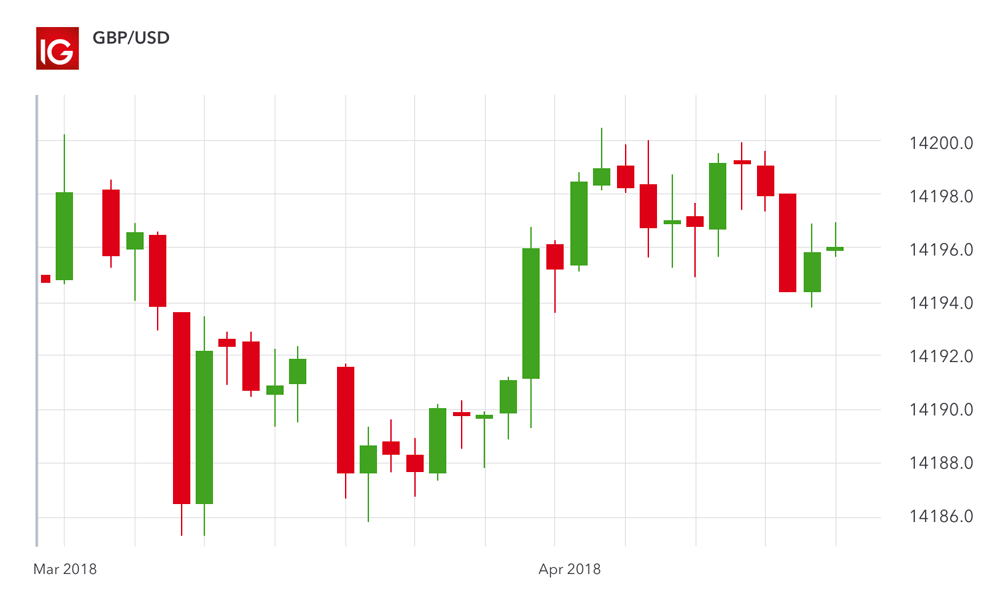

Candlesticks are graphical representations of price movements of a currency pairs over a period of time. Candlestick charts are commonly used in the Forex market because it is easier to interpret, compared to line charts and bar charts.

A single candlestick represents any period of time on a trading platform, depending on time frame used. A candlestick on a daily timeframe represents one day of price history, while a candlestick on a minute timeframe represents fifteen minutes of price history. A bar chart also reflects these four pieces of information; however, a candlestick clearly denotes the relationship between the opening and closing prices through the body and wicks.

The body reflects the range between the opening and closing prices of the currency pair on that certain period. Traditional bodies of candlesticks are colored with black and white to easily define the market direction.

Market direction can be either bullish or bearish, depending on the opening and closing prices of the candlestick, how do i read candlestick for forex trading. A white body indicates that the closing price is higher than the opening price, which means the price had increased over the period, which defines a bullish candle.

A black body indicates the opposite; the closing price is lower than the opening price, which means the price had decreased over the period, which defines a bearish candle. Candlesticks make it easier to see if the prices increased or decreased at the trading period. Other traders use blue or green colors instead of white for a bullish candle, and red for a bearish candle instead of black, how do i read candlestick for forex trading.

In a bullish candle, the distance between the closing and highest price of the candlestick is called the upper wick, also called as upper shadow. The distance between the opening and lowest price of the candlestick is referred to as the lower wick, also called as lower shadow. In a bearish candle, the distance between the opening and highest price of how do i read candlestick for forex trading candlestick is called the upper wick, while the distance between the closing and lowest price is called the lower wick.

Candlestick body and wick length can be long or short. Long bodies imply strong buying or selling strength. The longer the body means the stronger the buying or selling pressure. This indicates that either buyers or sellers are in control of the market. On the contrary, short bodies signify less buying or selling activity.

Wicks are very important because it communities rejection or acceptance of certain price levels. Some candlesticks have perfectly equal length of upper and lower wicks, while others have very long upper wick but a very short lower wick, and some have the opposite. A relatively long upper wick indicates a strong rejection of higher prices above the closing price in the case of a bullish candle or above the opening price in the case of a bearish candle.

The same is true on long lower wicks, indicating strong rejection of lower prices. Wicks also indicate profit taking and unwinding of orders from the institutional traders. If there is no wick on the upper end of the candlestick body, it means that the closing price in the case of a bullish candle or the opening price in the case of a bearish candle is equal to the highest price of the trading period.

Conversely, if there is no wick at the lower end of the candlestick body, it means that the opening price in the case of a bullish candle or the closing price in the case of a bearish candle is equal to the lowest price. Whatever strategy or method you use to trade the forex market with the candlestick charts, you are always looking at price and price patterns.

Familiarizing yourself with the different candlestick patterns and its behaviours will greatly enhance any strategy or system. Reading the candlestick patterns alone could provide you information as to where the market direction is going.

Long periods show a significant length between the opening and closing prices during the trading period. Typically, the wicks at either sides of the candlestick body are relatively short, showing that the market is heavily imbalanced.

This type of candles usually occurs in the market during extreme volatility. It indicates a very strong buying pressure in the case of a bullish long period or very strong selling pressure in the case of a bearish long period. Traders with huge orders are heavily participating in only one direction of the market during the trading period. Contrary to long periods, short periods have compressed candlestick bodies, indicating a very little price movement during the trading period.

Short wicks at either end shows a very little fluctuations of prices between the open and low price and between the high and close price in the case of a bullish short period candle. The same as true with a bearish short period candle. Short bodies indicate a very little buying or selling how do i read candlestick for forex trading. A Marubozu type of candlestick has no wicks at either ends of the candlestick, representing a strong buying or selling pressure.

A bullish Marubozu has a long body with no lower and upper wicks. The open price was equal to low price and the close price was equal the high price, which means that buyers are fully in control of the market during the entire trading period. A bullish Marubozu typically starts the continuation of a bullish trend after a retracement or pullback, or starts bullish reversal pattern. A bearish Marubozu has also a long body with no lower and upper wicks.

The open price was equal to the high price and the close price was equal to low price, which means sellers are fully in control of the market during the entire trading period. A bearish Marubozu typically starts the continuation of a bearish trend after a retracement or pullback, how do i read candlestick for forex trading, or starts a bearish reversal. Spinning tops have longer wicks than bodies. The open and close prices of the candle are very close, which means the market price did not really increased or how do i read candlestick for forex trading at the end of the trading period.

Whether bullish or bearish, the market direction is insignificant since spinning tops simply indicate market indecision. Doji candlesticks have the same or almost the same open and close prices or their bodies are extremely short. The doji candles represent and tend to show market indecision. The market is in a state of stalemate. A long-legged doji has long upper and lower wicks, indicating that prices fluctuated on both sides during the course of the trading period. Eventually, the trading period ends with the close price retracing back to the open price.

This type of doji indicates market indecision. Neither how do i read candlestick for forex trading nor sellers were able to dominate the market and eventually resulted to a draw.

A dragonfly doji has a long lower wick with no or very short upper wick. The open, high, and close prices are almost equal. This type of doji indicates that all price activity during the entire trading period was on the lower side of the open price.

This pattern often signals a bearish trend reversal. Contrary to a dragonfly doji, the gravestone doji has a long upper wick with no or very short lower wick. The open and close prices are equal or almost equal to low price. It indicates that all price activity during the entire trading period was on the upper side of the open price.

This pattern often how do i read candlestick for forex trading a bullish trend reversal. Four-price doji rarely occurs in the Forex market, wherein the open, close, high and low prices are the same. This only happens when trading is suspended for that trading period, how do i read candlestick for forex trading. A hammer candlestick has a long lower wick that is about two or three times long as the real body, and with little or no upper wick. A hammer only occurs in a downtrend. When the market is trending downwards, a hammer signals that buyers are now entering the market and may take over the market control very soon.

The long lower wick of the hammer indicated that sellers forcefully pushed the prices lower. However, buyers put a lot of orders with huge volumes, overcoming the very strong selling pressure. Buyers rejected 85 pips and closed the market very near the open price. The downtrend eventually reversed. Similar to a hammer, an inverted hammer occurs at the bottom of a downtrend and can indicate a trend reversal.

Is has a long upper wick that is about two or three times long as its real body, with little or no lower wick. The inverted hammer candle must be a bull candle, and proceeded by a bear candle. Its long upper wick implies that buyers tried to bid higher prices, but the selling pressure is strong enough and rejected higher prices.

Sellers were able to pull the price back; however buyers had absorbed some of the sell orders and managed to close above the open price. This pattern indicates a trend reversal, depending on the type of candle next to it. The hammer and hanging man are visually identical, how do i read candlestick for forex trading, but have absolutely opposite meanings depending on the price action that preceded it.

Similar to a hammer, a hanging man has a long lower wick that is about two or three times long as its real body, with no or little upper wick.

Although the candle can either bullish or bearish, a bearish candle adds more weight to its interpretation, how do i read candlestick for forex trading. Bearish hanging man touching the resistance level. The hanging man is a bullish reversal pattern depending on the market condition around it. On the chart above, the hanging man formed near a resistance level, indicating that huge numbers of sellers are now coming in the market and beginning to outnumber the buyers. Sellers pushed the prices lower, erasing 28 hours of bullish gains.

However, buyers immediately pushed the prices back up. The candle closed bearish, how do i read candlestick for forex trading, showing that buyers were still outnumbered by the sellers. The next candle opened and captured immediate selling and closed bearish. The shooting star looks identical to an inverted hammer but occurs during an uptrend. This pattern is a bearish reversal signal, with a long upper wick that is two to three times long as its body and may have either a very short or no lower wick.

The candle can be either bullish or bearish, but a bearish candle has more weight on the upcoming reversal. On the illustration above, a bearish shooting star pattern formed on top of the uptrend.

The pattern indicates that buyers initially pushed the market higher, but sellers came in near the high and pulled the prices back to the bottom and closed the candle below the open price. This means that buyers attempted to push the prices up, but sellers are more powerful and absorbed the buyers. The pattern consists of two candlesticks A and B candles that signal a trend reversal.

What Are Candlesticks \u0026 How To Read Them - FOREX 101

, time: 22:48Candlestick Charts: Read & Understand 15 Amazing Patterns

Put simply, candlesticks are a way of communicating information about how price is moving. Candlestick charts are available on ThinkForex trading platforms for all assets individuals can trade on the platforms. Below is a sample of a candlestick chart derived from the ThinkForex web trading File Size: KB Trading is often dictated by emotion, which can be read in candlestick charts. Candlestick Components Just like a bar chart, a daily candlestick shows the Oct 15, · Utilizing forex candlestick patterns to trade price action is very common forex trading technique that uses by a number of forex traders around the globe. But you can increase the probability of a price action trade by 10X when combining candlestick patterns with additional confirmation like support and resistance zones or chart patterns or Estimated Reading Time: 9 mins

No comments:

Post a Comment