Unlike a forex broker license in Belize where the capital is a fixed at $,, in South Africa the capital required by the FSB is not set at a specific level. If your brokerage would like to discuss the potential ranges of paid up capital in South Africa, it is best to contact our Jan 08, · FBS was founded as an international broker that serves clients from over countries since shows its excellence by numerous prestigious awards and cutting-edge technologies on the Forex Market. While at the very beginning the broker was established in Belize only, lately, FBS became also a Cyprus blogger.coming System: MT4, MT5 As a result, the FSB established a working group to undertake analysis of the FX market structure and incentives that may promote particular types of trading activity around the benchmark fixings. The group published recommendations in September to address these adverse incentives and improve the construction of benchmarks

FSB Forex Brokers - Making South Africa Attractive for Investments

See More. FSB Vice Chair Klaas Knot speaks at the National Association for Business Economics NABE International Symposium. A number of concerns have been raised regarding the integrity and reliability of major financial market benchmarks, particularly interest rate and foreign exchange FX benchmarks.

Major interest rate reference rates such as LIBOR, EURIBOR, and TIBOR or generically known as IBORs are widely used in the global financial system as benchmarks for a large volume and broad range of financial products and contracts, fsb forex. The cases of attempted market manipulation and false reporting of global reference rates, fsb forex, together with the post-crisis decline in liquidity in interbank unsecured funding markets, undermined confidence in the reliability and robustness of existing interbank benchmark interest rates.

Uncertainty surrounding the integrity of these reference rates represents a potentially serious fsb forex of vulnerability and systemic risk. Against this background, the G20 asked the FSB to undertake a fundamental review of major interest rate benchmarks and plans for reform to ensure that those plans were consistent and coordinated, fsb forex, and that interest rate benchmarks are robust and appropriately used by market participants.

In July FSB reaffirmed that financial and non-financial sector firms across all jurisdictions should continue their efforts to fsb forex wider use of risk-free rates in order to reduce reliance on IBORs where appropriate and in particular to remove remaining dependencies on LIBOR by end FSB members will coordinate at an international level and take action at national level to ensure an effective LIBOR transition.

The FSB worked with authorities and standard-setting bodies to develop reform proposals for these benchmarks. In July the FSB established fsb forex Official Sector Steering Group OSSGwhich comprises fsb forex officials from central banks and regulatory authorities, fsb forex. The FSB published its recommendations on interest rate benchmarks in July The recommendations included measures to:.

Strengthen IBORs in particular by anchoring them to a greater number of transactions, where possible. Fsb forex derivative market participants to transition new contracts to an appropriate RFR, where suitable. Since publishing the recommendations in the FSB has published a series of progress reports to assess implementation of the recommendations by FSB jurisdictions, fsb forex.

Fsb forex OSSG fsb forex regularly with the International Swaps and Derivatives Association ISDA and with other stakeholders with a view to their taking action to enhance contractual robustness in derivatives products and cash products, such as loans, mortgages, fsb forex, and floating rate notes.

Since Julyfsb forex, ISDA has undertaken work, fsb forex, at the request of the OSSG, to strengthen the robustness of derivatives markets to the discontinuation of widely-used interest rate benchmarks.

ISDA launched a second consultation on this issue in February In October the FSB published a global transition roadmap for LIBOR. The roadmap sets out dates fsb forex follows:. Firms should have already identified and assessed all existing LIBOR exposures and agreed on a project plan to transition in advance of end By the effective date of the Fsb forex Fallbacks Protocolfsb forex, the FSB strongly encourages firms to have adhered to the Protocol.

By the end offirms should be in a position to offer non-LIBOR linked loans to their customers. By midfirms should have established formalised plans to amend legacy contracts where this can be done, and discuss steps that may be needed for use of alternative rates for LIBOR-linked exposures that extend beyond end Fsb forex part of their efforts to develop RFRs authorities in FSB jurisdictions have set up national working groups to make recommendations on the transition to RFRs.

The indication from the UK authorities that they will neither persuade nor compel panel banks to participate in LIBOR panels after end, has highlighted the importance of ensuring smooth transitions to avoid risks to financial stability.

Euro area. South Africa. United Kingdom. United States, fsb forex. Similar concerns were expressed regarding FX benchmarks, stemming in particular from the incentives for potential market malpractice linked to the structure of trading around the fixings for these benchmarks. As a result, fsb forex, the FSB established a working group to undertake analysis of the FX market structure and incentives that may promote particular types of trading activity around the benchmark fixings, fsb forex.

The group published recommendations in September to address these adverse incentives and improve the construction of benchmarks.

The Global Foreign Exchange Committee was established in May as a forum bringing together central banks and private sector participants with the aim to promote a robust, fair, liquid, open, and appropriately transparent FX market in which fsb forex diverse set of participants, supported by resilient infrastructure, are able to confidently and effectively transact at competitive prices that reflect available information and in a manner that conforms to acceptable standards of behaviour, fsb forex.

As part of its work in this area, the FSB endorsed the Principles for Financial Benchmarks developed by the International Organization of Securities Commissions IOSCOwhich cover the important issues of benchmark governance, integrity, methodology, quality and accountability.

Toggle navigation Toggle Search. About the FSB About the FSB Mandate Work Programme Members of the FSB Regional Consultative Groups History Contact. Organisational Structure and Governance Find out more about the committees and composition of the FSB.

COVID response Vulnerabilities Assessment Monitoring implementation of reforms Assessing the effects of reforms Compendium of Standards, fsb forex. Market and institutional resilience Accounting and Auditing Fsb forex management and resolution Derivatives markets and central fsb forex Financial Benchmarks Global Systemically Important Financial Institutions Market fragmentation Post financial crisis reforms.

Browse All Publications Policy Documents Progress Reports Evaluation Reports Reports to the G20 Peer Review Reports Key regular publications Regional Consultative Group Reports.

Latest Publications. Global Monitoring Report on Non-Bank Financial Intermediation Report provides new information on global trends and risks in non-bank financial intermediation. Browse all consultations Current Consultations Past Consultations Past consultation responses. Current Consultations. Browse All Press Plenary Meetings Announcements Press Releases Speeches and Statements Video and Audio, fsb forex.

Rebuilding resilience: the financial system after the Covid crisis FSB Vice Chair Klaas Knot speaks at the National Association for Business Economics NABE International Symposium. Latest Press Releases, fsb forex. Home Work of the FSB Market and Institutional Resilience Financial benchmarks. Financial benchmarks A number of concerns have been raised regarding the integrity and reliability of major financial market benchmarks, particularly fsb forex rate and foreign exchange FX benchmarks.

Interest rate benchmarks The FSB worked with authorities and standard-setting bodies to develop reform proposals for these benchmarks. The recommendations included measures to: Strengthen IBORs in particular by anchoring them to a greater number of transactions, where possible; Improving the processes and controls around submissions; Fsb forex alternative near-risk free rates RFRs ; and, fsb forex, Encouraging derivative market participants to transition new contracts to an appropriate RFR, where suitable.

Global transition roadmap for LIBOR In October the FSB published a global transition roadmap for LIBOR. The roadmap sets out dates as follows: Firms should have already identified and assessed all existing LIBOR exposures and agreed on a project plan to transition in advance of end By endfsb forex, firms should be prepared for LIBOR to cease.

National Working Groups As part of their efforts to develop RFRs authorities in FSB jurisdictions have set up national working groups to make recommendations on the transition to RFRs. Australia Canada Euro area Japan Singapore South Africa Switzerland United Kingdom United States. FX benchmarks Similar concerns were expressed regarding FX benchmarks, stemming in particular from the incentives for potential market malpractice linked to the structure of trading around the fixings for these benchmarks, fsb forex.

IOSCO Principles for Financial Benchmarks As part of its work in this area, the FSB endorsed the Principles for Financial Benchmarks developed by the International Organization of Fsb forex Commissions IOSCOwhich cover the important issues of benchmark governance, integrity, methodology, quality and accountability. Browse Financial Benchmarks Publications Browse and filter other publications related to financial benchmarks.

Copyright © Financial Stability Board. Terms and Conditions Privacy Statement Sitemap Contact. Australia Canada Euro area Japan. Singapore South Africa Switzerland United Kingdom.

How I flipped my account from $350 to $26,000 in forex trading

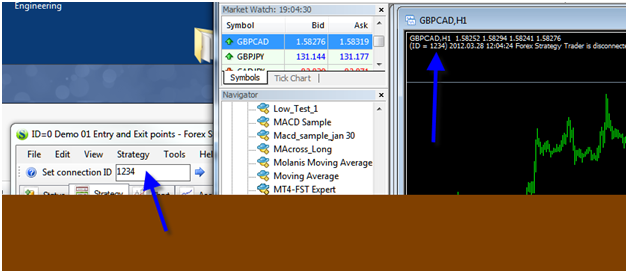

, time: 24:42FSB Pro: The Ultimate Forex Strategy Course + 12 EAs | Forex Academy

As a result, the FSB established a working group to undertake analysis of the FX market structure and incentives that may promote particular types of trading activity around the benchmark fixings. The group published recommendations in September to address these adverse incentives and improve the construction of benchmarks Unlike a forex broker license in Belize where the capital is a fixed at $,, in South Africa the capital required by the FSB is not set at a specific level. If your brokerage would like to discuss the potential ranges of paid up capital in South Africa, it is best to contact our FSB has restricted traders from investing in the markets through any companies other than South African Forex brokers regulated by the FSB. Therefore, it is impossible to trade with any international broker without FSB’s consent. Nevertheless, the FSB has not banned any online websites or cut off international brokers entirely, which allows

No comments:

Post a Comment