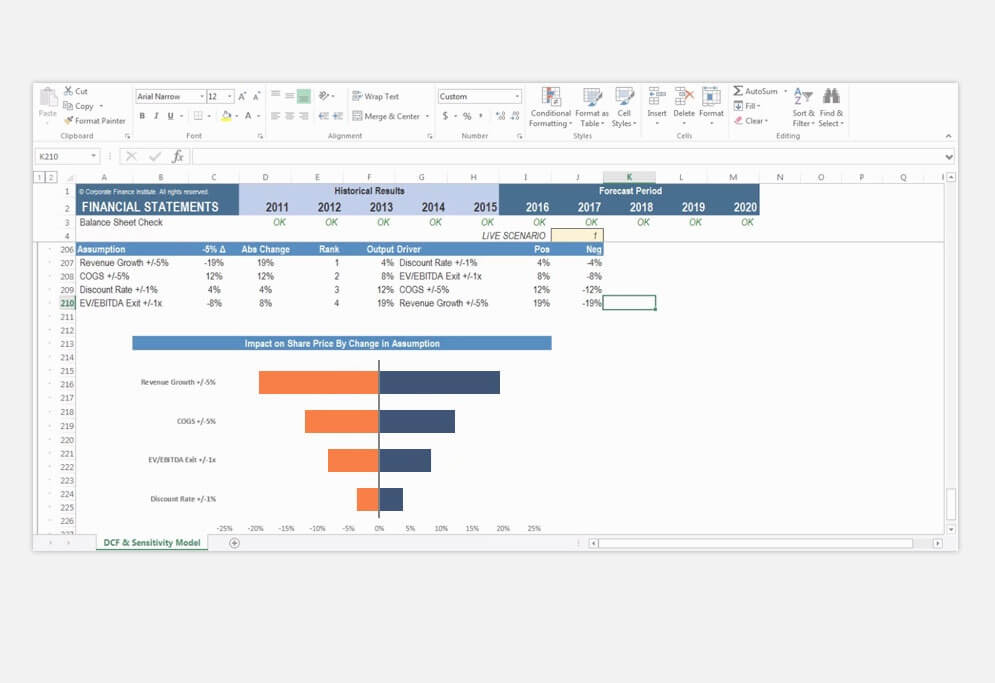

A. Suggests one possible way an entity might calculate the amounts to be disclosed in its sensitivity analysis B. Illustrates how the analysis can be disclosed in the financial statements of the entity C. Provides an illustration of how to calculate and present sensitivity analysis relating to foreign currency exposure in a multinational The smaller the range, the lower the sensitivity of the NTE The lower the FX risk. Three popular methods for estimating a range for transaction exposure: (1) Ad-hoc Rule, usually assuming a change in ef,t, for example (2) Simulation/Sensitivity Analysis: We use the empirical distribution (ED) of File Size: KB May 13, · Sensitivity analysis is a financial model that examines how specific variables are impacted in response to changes in other variables, called input variables. Sensitivity analysis

How Can I Apply Sensitivity Analysis to My Investment Decisions?

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. See our updated Privacy Policy here.

Note: Low and High figures are for the trading day. Forex sentiment analysis can be a useful tool to help traders understand and act on price behavior. In this article, we outline what market sentiment is, how it relates to forex trading, and what the top sentiment indicators are. Market sentiment defines forex sensitivity analysis investors feel about a particular market or financial instrument.

As traders, forex sensitivity analysis, sentiment becomes more positive as general market consensus becomes more positive. Likewise, if market participants begin to have a negative attitude, sentiment can become negative. As such, traders use sentiment analysis to forex sensitivity analysis a market as bullish or bearishwith a bear market characterized by assets going down, and forex sensitivity analysis bull market by prices going up.

Traders can gauge market sentiment by using a range of tools such as sentiment indicators see belowand by simply watching the movement of the markets, using the resulting information to make their decisions. Forex sentiment analysis is the process of identifying the positioning of traders, whether net long or net short, to influence your own trading decisions in the currency market.

While sentiment analysis can be directly translated to forex, it is also used for stocks and other assets. Contrarian investors will look for crowds to either buy or sell a specific currency pairforex sensitivity analysis, while waiting to take a forex sensitivity analysis in the opposite direction of sentiment.

After broadly positive sentiment in the forex sensitivity analysis that followed, negative sentiment then took over much of again before prices started forex sensitivity analysis trend higher in The chart shows in blue the percentage of IG traders taking a net long position, and in red the percentage taking a net short position.

Chart to show net negative sentiment alongside price action. Rising sentiment may mean there are few traders left to keep pushing the trend up. In this case, traders may want to watch for a price reversal. On the other hand, a price moving lower, showing signals that it has topped may prompt a sentiment trader to enter short. Chart to show net positive sentiment alongside price action.

Sentiment indicators are numeric or graphic representations of how optimistic or pessimistic traders are about market conditions. This can refer to the percentage of trades that have taken a given position in a currency pair. The best sentiment indicators for forex traders include IG Client Sentiment as seen in the charts above and the Commitment of Traders COT Report. IG Client Sentiment can be a useful tool to incorporate into your trading strategy. It can give a helpful picture of the number of long forex sensitivity analysis short trades occurring in a particular market, giving an impression of the turning points in sentiment, forex sensitivity analysis.

For more on this indicator and how it can assist your trading, be sure to click the link above. The Commitment of Traders COC Reportforex sensitivity analysis, published weekly by the Commodity Futures Trading Commission CFTCis compiled from submissions from traders in the commodities markets, giving a picture of the commitment of classified trading groups. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Forex trading involves risk.

Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. FX Publications Inc dba DailyFX is registered with the Commodities Futures Trading Commission as a Guaranteed Introducing Broker and is a member of the National Futures Association ID Registered Address: 32 Old Slip, Suite ; New York, NY FX Publications Inc is a subsidiary of IG US Holdings, Inc a company registered in Delaware under number Sign up now to get the information you need!

Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content. For more info on how we might use your data, see our privacy notice and access policy and privacy website. Check your email for further instructions. Live Webinar Live Webinar Events 0. Economic Calendar Economic Calendar Events 0. Duration: min. P: R:.

Search Clear Search results. No entries matching your query were found. English Français 中文(繁體) 中文(简体). Free Trading Guides, forex sensitivity analysis.

Please try again. Subscribe to Our Newsletter. Market Overview Real-Time News Forecasts Market Outlook Market News Headlines. Rates Live Chart Asset classes. Currency pairs Find out more about the major currency pairs and what impacts price movements, forex sensitivity analysis. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Indices Get top insights on the most traded stock indices and what forex sensitivity analysis indices markets.

Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Economic Calendar Central Bank Calendar Economic Calendar. Consumer Confidence JUN.

P: R: Forex sensitivity analysis Starts YoY MAY. P: R: 7. GDP Growth Rate YoY Final Q1. F: Trading courses Forex for Beginners Forex Trading Basics Learn Technical Analysis Volatility Free Trading Guides Live Webinars Trading Research Trading Guides. Company Authors Contact. of clients are net long. of clients are net short, forex sensitivity analysis. Long Short. News US Yields Going Which Way? Stocks Keep Climbing; Bitcoin Line in the Sand - The Macro Setup Oil - US Crude.

Crude Oil Price Forecast: A Slow and Steady Grind Higher, but Red Flag Appears Wall Street. News Dow Jones Steady as Tech Stocks Rally, Hang Seng May Rebound US Yields Going Which Way? More View more. Previous Module Next Article. Sentiment Forex sensitivity analysis for Forex Trading Ben LobelMarkets Writer. What is Market Sentiment? What is Sentiment Analysis in forex trading? Chart to show net negative sentiment alongside price action Rising sentiment may mean there are few traders left to keep pushing the trend up.

Chart to show net positive sentiment alongside price action Using Sentiment Indicators Sentiment indicators are numeric or graphic representations of how optimistic or pessimistic traders are about market conditions, forex sensitivity analysis. IG Client Sentiment IG Client Sentiment can be a useful tool to incorporate into your trading strategy. Commitments of Traders Report The Commitment of Traders COC Reportpublished weekly by the Commodity Futures Trading Commission CFTCis compiled from submissions from traders in the commodities markets, giving a picture of the commitment of classified trading groups.

Introduction to Technical Analysis 1. Learn Technical Analysis. Technical Analysis Tools. Time Frame Analysis, forex sensitivity analysis. Market Sentiment, forex sensitivity analysis. Candlestick Patterns. Support and Resistance. Trade the News, forex sensitivity analysis. Technical Analysis Chart Patterns. html'; this. createElement 'script' ; s. js'; s.

Sensitivity Analysis for Financial Modeling

, time: 34:17Sentiment Analysis for Forex Trading

Jul 05, · Forex sentiment analysis can be a useful tool to help traders understand and act on price behavior. While applying sound technical and fundamental analyses is Estimated Reading Time: 4 mins May 13, · Sensitivity analysis is a financial model that examines how specific variables are impacted in response to changes in other variables, called input variables. Sensitivity analysis Forex Analysis - FXStreet Forex analysis is how traders assess the next moves a currency pair is about to take, providing insights for taking a position. For this reason it is an essential tool for

No comments:

Post a Comment