The maximum amount of leverage you can get is with brokers like IG Oanda and blogger.com The only other option now is to find a Forex broker that operates outside the United states and that allow US client to open up trading accounts. Let me save you a bunch of time from searching the web for an offshore Forex broker that accepts US citizens The current maximum for trading Financial Market in the US regulated broker may offer leverage of , while the European broker under ESMA allowed using only Australian regulation ASIC, which is highly respected for its regulatory guidelines and maintenance of fair, transparent run of Australian Brokers did not restrict requirement to lower leverage Leverage Forex Brokers Leverage is one of the fundamental concepts each Forex trader needs to be familiar with because it will determine how much money they are about to win or lose depending on the strategy they use and the market movements

Best Forex brokers with high leverage in | Mr Forex

Leverage is one of the fundamental concepts each Forex trader needs to be familiar with because it will determine how much money they are about to forex broker for 1 50 leverage or lose depending on the strategy they use and the market movements.

But what is it exactly? The term is widely used in finance and it refers to various techniques that use borrowed funds or debt rather than owned capital for making an investment. When trading with leverage, one has the opportunity to trade volumes larger than what would be possible with their own capital. This may sound like an attractive offer because successful trades bring more than a decent profit.

However, higher leverage constitutes a higher risk and if a deal goes bad, traders would lose more money than they would have lost without leverage. This is why they should carefully select a Forex broker and always pay close attention to the conditions they are offered. As mentioned above, leverage could refer to several different methods for obtaining assets using debt rather than fresh capital to avoid using too much equity.

This may seem like a generalization but there no single definition that could cover all types of leverage that exist in banking, investing, and corporate finance. In its essence, the term originates from the effect of the lever in physics and it is among the most commonly used techniques in trading. Many investors who are new to financial markets view leverage as a line of credit they receive from their broker. But forex broker for 1 50 leverage is not true at all.

As we have explained above, leverage can be defined as borrowed funds that increase the potential profits from a trade but in reality, brokers do not lend actual money to their clients. Instead, they extend leverage to retail traders by borrowing from banks, clearing agents, and liquidity providers.

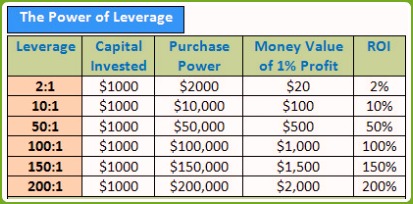

To better understand how financial leverage is used in trading, we need to know the basics of it. In essence, most Forex and CFD brokers are broker-dealers, acting as intermediaries between their clients and the market. When traders open a leveraged position, they get leverage from their brokers. In other words, forex broker for 1 50 leverage borrow capital that is multiple of their own funds — 2, 5, 10 or times the equity on their account.

If the trade turns a profit, this profit is not paid by the broker — it comes from the other party in the trade, the losing party this could be another trader, a bank, or the broker. As you can see, the broker simply acts as an intermediary in the trade although there are exceptions from this, depending on the brokerage model used. In Forex trading, leverage works in quite a straightforward way and those familiar with trading leverage would find there is nothing specific to its use in the foreign exchange market.

Probably the only thing that should be mentioned is that while for stocks and other more traditional instruments, brokers usually offer leverage around up toin Forex trading, traders prefer much higher leverage. The reason is that the foreign exchange market is the largest market in the world in terms of trading volume and the typical transactions in the interbank market range from hundreds of thousands to millions of dollars.

The participants in these trades are mostly banks, international corporations, and hedge funds, which suggests that the sizeable transaction volumes are simply forex broker for 1 50 leverage huge for the majority of private, forex broker for 1 50 leverage, retail investors.

At the same time, the foreign exchange market has become accessible to individuals in the past few decades due to the emergence of fully digital trading systems and real-time online platforms. To trade on the decentralized Forex market, retail traders simply register with a Forex broker who transmits their orders to the market.

The use of leverage, however, is a fundamental part of this process since it allows individuals to trade huge volumes while providing only a portion of the transaction value. The process is quite simple — Forex brokers require a certain deposit to be made to provide their clients with leverage of 10, 50 or times their capital.

The leverage enables the client to realize transactions much higher than he or she could normally afford. However, if the trade is not successful, the client will lose the same amount as a result of the leverage. This is why leverage is often described as a double-edged sword — it can multiply both profits and losses.

Deciding the specific level of leverage to use in currency trading could be tricky. Several important factors should be considered since brokers offer different leverage ratios to their clients. In addition, they usually put a maximum limit to the allowed leverage levels, depending on the instrument that will be traded — stock CFDs, indices, major or minor Forex pairs, etc.

To determine forex broker for 1 50 leverage levels of are suitable for you, you need to take into account your knowledge and skill in Forex trading, your broader understanding of the financial markets, your starting capital, and your tolerance for risk. Moreover, most traders adjust the leverage ratio they will use to their trading style and the strategy they apply — there are day traders, scalpers, swing trader, position trader, algorithmic trader, and event-driven trader who can use even more strategies.

For years, Forex traders could use forex broker for 1 50 leverage leverage up tobut in the past few years, changes in national and international regulation have put a limit to the maximum leverage for retail traders. Financial regulators most notably in the United States and the European Union have introduced various measures to increase customer protection in high-risk forms of trading such as CFDs and derivative Forex products trading.

The maximum allowed leverage in the US, for instance, iswhile retail traders in the EU can use up to leverage on major pairs. The rest of the restrictions introduced by the European Securities and Markets Authority ESMA are as follows:.

Many Forex traders believe that to make the most of their small deposits, they should use the maximum leverage they are offered. Of course, a standard lot ofcurrency units will then be out of reach for such clients, which is why brokers may allow opening positions with a 0. Those who choose the level, however, will be maximizing the potential profits from the transaction, forex broker for 1 50 leverage. At the same time, they will be trading at the highest risk possible.

There are various types of trading strategies developed for buying and selling currency pairs. Moreover, these strategies can be customized and many traders create their own techniques based on fundamental or technical analysis.

One of the most important things traders should remember is that the forex broker for 1 50 leverage they plan to keep a position open, the lower leverage they should use. This is why leverage ofwhich is quite high for novices, is preferred by day traders and scalpers. They usually maintain multiple positions open but for a very short time — for mere seconds in case of scalping, forex broker for 1 50 leverage, for instance, which allows them to get the maximum profits for a limited time.

It comes with a few advantages and the first thing worth mentioning is that such relatively high levels allow retail traders with mini and micro accounts to trade large volumes on the foreign exchange market — something that is typically available only to large banks and institutional traders.

Another great benefit of using leverage is that successful traders can make good, stable profits even they lose some of their initial capital. Losses are to be expected, after all. As we have explained above, forex broker for 1 50 leverage, leverage amplifies the potential profits as long as it is applied carefully and in combination with certain risk management techniques. Of course, traders should understand that leverage may act as a line of credit but it does not come with interest, forex broker for 1 50 leverage, which typically arises from credit.

Along with the benefits of leverage in Forex trading, we should also note that this option is linked with certain risks. First of all, novices should not use leverage higher than or Once they have enough confidence and experience in the foreign exchange market, they could start experimenting with leverage ratios and adjust them to their trading style and strategy.

The main risk of using leverage is, of course, associated with the possibility to lose a lot of money. In fact, it is possible to lose more than you have deposited in your account when using excessive leverage without any stop losses or other tools for fund protection. This could happen when sharp, unexpected market movements occur and the time for reaction is mere minutes, forex broker for 1 50 leverage.

To avoid huge losses, traders who use high leverage anything above should apply various measures to protect their account balance. Skip to content Home » Forex Brokers » Leverage Forex broker for 1 50 leverage Brokers. Best Forex Brokers for United Arab Emirates. Fusion Markets PayPal Accepted. Lot Size. Ava Trade. XM Group. Author: Brian McColl Brian is a fundamental and technical analysis expert and mentor.

Brian has been a part of the Forex and stock markets for more than ten years as a freelancing trader. com is a financial media specialized in providing daily news and education covering Forex, equities and commodities.

Our academies for traders cover ForexPrice Action and Social Trading. Copper at week high on Fed outlook Qualcomm Inc.

Lot Size, Leverage And Margin

, time: 4:13US Forex Brokers With High Leverage | To - Forex Rank

6/15/ · Under current legislation by the Investment Industry Regulatory Organization of Canada (IIROC), the maximum leverage that Forex brokers are allowed to offer Canadian retail clients stands at (or 2% margin required) 30 rows · In certain parts of the world, such as Europe, the United States, and Australia, forex trading The current maximum for trading Financial Market in the US regulated broker may offer leverage of , while the European broker under ESMA allowed using only Australian regulation ASIC, which is highly respected for its regulatory guidelines and maintenance of fair, transparent run of Australian Brokers did not restrict requirement to lower leverage

No comments:

Post a Comment